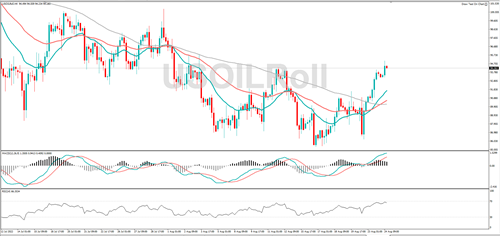

WTI rallied to a three-week high, and positive momentum is gaining ground, indicating the bulls are in control. It might target 95.85 or 97.54. Should the market fall from here, it could find support at 92.85 or 91.46.

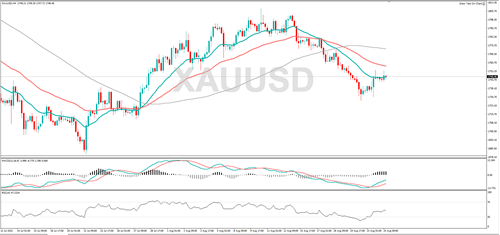

Gold has rebounded, RSI has moved out of oversold territory, and momentum is now positive, both speak to bullish sentiment. If the rally continues, it might hit 1758 or 1766. A retreat from here could see it retest 1739, or target 1730.

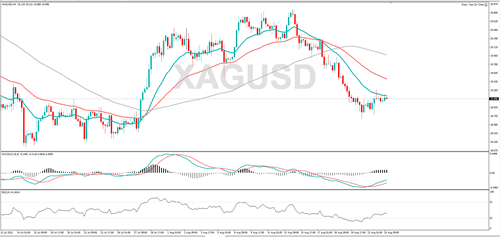

Silver hit a three-week low on Tuesday and it has recovered a little since. Momentum has turned positive, which suggests the bulls are back in control. 19.27 or 19.40 might act as resistance. If the broader bearish trend continues, support might be found at 18.71 or 18.64.

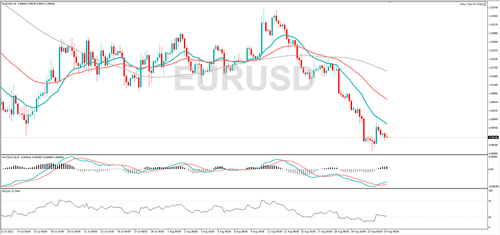

EUR/USD fell to a fresh 20-year low yesterday, but momentum has turned positive, suggesting the bulls are now in control. If the wider downtrend continues, it might target 0.9900 or 0.9800. If the short-term rebound continues, it might hit 1.0000 or 1.0039.

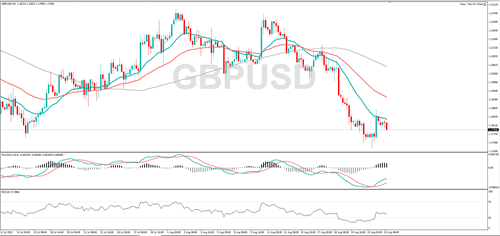

Yesterday, GBP/USD traded at a 17-month low, and if the bearish trend continues, it might target 1.1756 or 1.1716. RSI is moving higher, implying the price bias is to the upside. If the recovery continues, 1.1877 or 1.1895 might act as resistance.

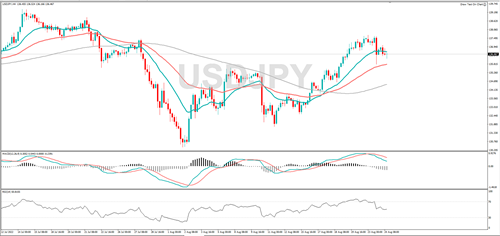

USD/JPY retreated from its one-month high. If the uptrend continues, 137.03 or 137.61 might act as resistance. RSI is falling, suggesting the price bias is to the downside, a fall from here could see it find support at 135.80 or 135.63.

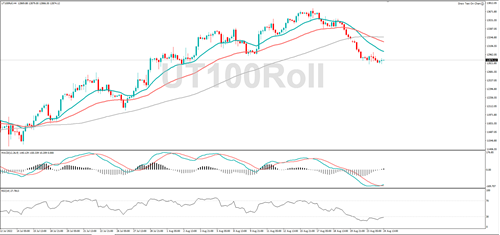

Yesterday, the UT100 dropped to its lowest mark in almost two weeks, it has been trading in a small range since then. If the medium-term bearish trend continues, it might target 12795 or 12772. Momentum has swung to positive territory, indicating the buyers are back in control. Resistance might be found at 13000 or 13074.