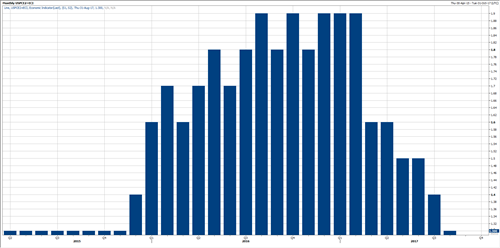

Since the beginning of the week, the US Dollar Index has been declining, despite the fact that the US Jobs Report which was released on Friday came in with a notable improvement in wages growth, driving the Fed Fund Futures to spike to 87% chance for 25bps rate hike in December meeting.

The declines comes with no significant economic releases, while it looks like that the current decline might be either a technical retracement, or the beginning of another bearish trend.

Technical Outlook

Looking at the daily chart, the US Dollar Index retracement continued last week until it tested the solid resistance area, which stands at 94.15, before sliding back and closed last week’s trading with a bearish shooting star on the daily chat.

The decline continued since the beginning of the week, and yesterday, it posted the biggest daily decline since the beginning of September, sliding all the way back to as low as 93.20’s.

In the meantime, the US Dollar Index remains above its short term up trend line as shown on the chart. The key support stands around 93.0, followed by the two uptrend lines shown on the chart, which stands between 92.80 and 92.50’s, which should be watched very closely over the coming days.

A break through those levels, would confirm that the upside retracement, which began in September is over, and the downside trend has resumed.

Such decline might continue all the way back to 92.26, which represents the 61.8% from the recent rally, which could be the last chance for a possible rally. A breakthrough that support would mean that the Index is likely to slide further back to 91.70 and 91.0. as well.

Fundamental Catalysts

Despite the fact that it has been a calm week for the US with no significant economic releases yet, there are still some fundamental catalysts ahead of us, which would give us a clearer signs of the next move.

These catalysts includes the FOMC Meeting Minutes later today, PPI figures on Thursday and the inflation data on Friday, which would be the key.

For the past few months, inflation has been declining gradually, and lately, the most respected inflation index for the Fed (Core PCE Price Index) posted the lowest level since 2015. Therefore, another drop in inflation would not support the Federal Reserve idea to raise rates in December.

FOMC Meeting Minutes Ahead

Today at around 10:00 PM Dubai Time / 06:00 PM GMT, all eyes will turn toward the Federal Reserve Meeting Minutes.

However, traders should be aware that this might be a non-event, as this is the minutes of the previous meeting, which was written before the US Jobs Report.

Yet, what matters the most here, if the general consensus of the members supports another rate hike in December, then the Jobs Report will be consider as a confirmation of December meeting, at least until the next jobs report, who knows, wages growth might be revised lower or higher in November.

If, the meeting minutes showed a split, this would keep the market in uncertainty mode, and investors would wait for the inflation data to decide on the next move.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst