The US Dollar failed to rally yesterday, despite the fact that the inflation data came in higher than expected. This shows how much USD bears are still in control, since inflation failed to push the US Dollar higher, retail sales data is unlikely to succeed in pushing it higher once again.

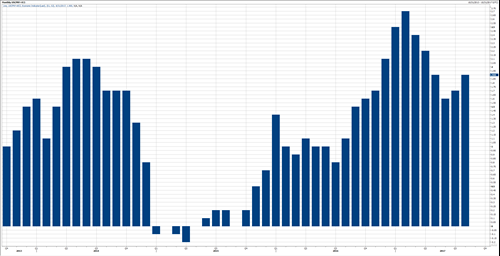

CPI YoY Nearing 2%

The YoY CPI came in higher than expected, rising to 1.9% in August up from 1.7% in July, while the estimates were to rise toward 1.8% only. This is the second monthly increase in a row, matching the highest level since May of this year.

Core CPI YoY Unchanged

This was disappointing, as it stabilized at 1.7% for the past four months (May, June, July and August), which is the lowest level of Core Inflation since May of 2015. This is despite the fact that it had been anticipated to decline slightly to 1.6%. Yet, the market did not rake this reading as good news.

US Data Ahead

During the US Session ahead, there are a many economic figures will be released today, including Retail Sales, Core Retail Sales, Empire State Manufacturing Index, Capacity Utilization Rate, Industrial Production and the initial UoM Consumer Sentiment Index.

Estimates for today’s data are mixed, but mostly positive. Yet, we cant rule out a surprise whether positive or negative.

What Matters The Most?

Traders need to keep an eye on the Retail Sales and Core Retail Sales figures. The Retail Sales is expected to show an increase of 0.1% in August compared to 0.6% in July, which would be the second monthly increase in a row, one we have not seen since the beginning of this year.

The Core Retail Sales is expected to print a strong reading of 0.5% in August, matching July’s outcome, which would be the third biggest MoM increase of this year, and the second monthly increase in a row.

Any disappointment from today’s data is likely to have a notable impact on the markets, at least until NYSE lunchtime.

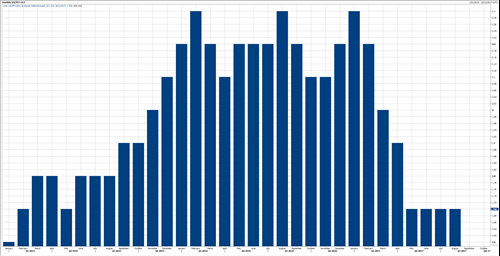

USD Index Failed To 92.55

This is one of the most interesting moves that we saw this week. The US Dollar managed to rise at the beginning of the week and continued its rally yesterday right after the inflation data, testing its 92.50 resistance area, which used to be a major support area back in May of 2016.

The index failed to sustain its initial rally right after the inflation data, declining all the way back to 91.90’s earlier this morning.

Looking at the weekly chart, the weekly candle is showing a clear reversal candle, especially if it closes the week below 92.0.

If so, this would be a new sign that the downward trend is here to stay and likely to extend later next week.

From a technical point of view, the weekly chart shows that there is no significant support area before 89.50’s, which might be the index’s next stop.

At the same time, we cant rule out a short term retracement to the upside, but this time, it might be limited below this week’s high around 92.50’s.

On the downside view (Daily Chart), the first immediate support stands at 91.50 followed by 90.50 and 90.0. Those are the levels that we will be watching over the next few hours and during next week’s trading.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst