During the Asian session today, there were few key economic figures from Australia, which had a notable impact on the markets, especially AUD pairs.

Despite the fact that some of the data were positive, AUD managed to decline across the board, as the long-term data slowed down significantly.

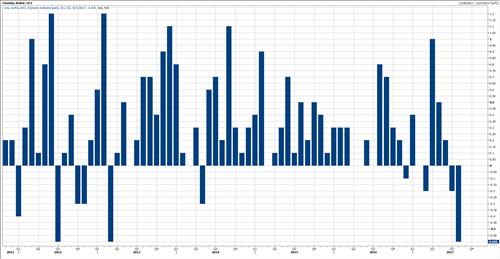

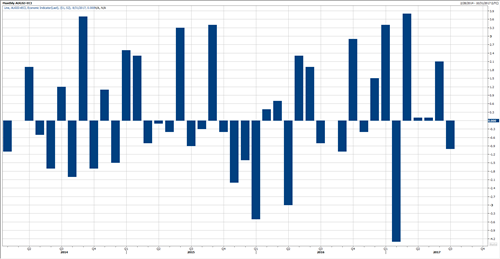

Retail Sales MoM Tumbled in August

The MoM Retail Sales came in with a negative shock, declining by -0.6% in August after declining by -0.2% in July, despite the fact that the estimates were to rise by 0.3%.

August’s decline is the biggest MoM decline since March of 2013, posting the second monthly decline in a row, one we have not seen since 2012.

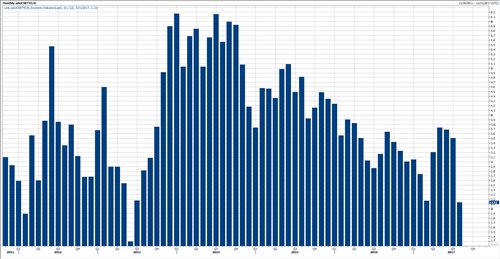

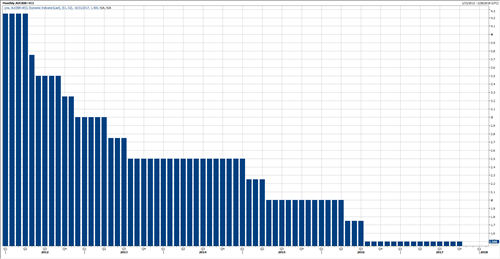

Retail Sales YoY Slowed in August

The YoY Retail Sales also came in with a shock, slowing down significantly to 2.1% in August down from 3.5% in July, while the estimates were to advance toward 3.6%.

This is the third YoY slowing down in a row and the weakest reading since June of 2013.

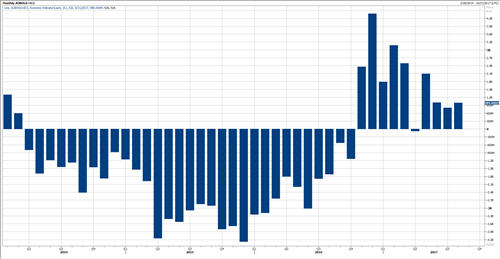

Positive Trade Balance

The Trade Balance was a little bit of a relief, but it also failed to support AUD. Trade Balance posted its fourth trade surplus in a row, one we have not seen since last year.

Trade Balance surplus increased to 989M in August, while the estimates were to rise to 857M only. Moreover, the previous reading has been revised sharply higher top 808M instead of 460M. This is also the highest surplus in two months.

The increase of the trade surplus came on the back of exports, which increased for the first time in two months, rising by 1.0% in August after two months of consecutive declines including June and July.

At the same time, Imports came in unchanged in August, after declining by -1% in July, which was the biggest monthly decline since February of this year.

What Does It Mean For RBA?

The Reserve Bank of Australia showed a dovish tone in its latest meeting, trying to push AUD lower as much as possible.

RBA noted many times this year that AUD is overvalued, and a strong currency will complicate the economic transition. Yet, AUD managed to remain strong, mostly on lower USD across the board this year.

In the meantime, with Retail Sales declines and softer labour market, the RBA has more room to keep the current policy unchanged for the time being, with more room to be more dovish, this is what the market is pricing in for now.

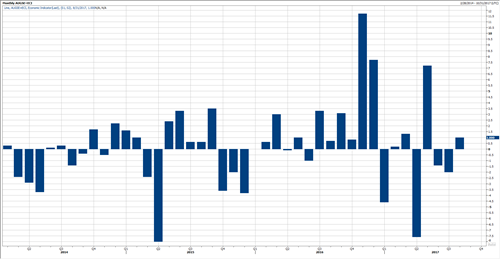

AUDUSD Nearing Key Support

The AUDUSD tried to break above 0.78 since April of last year, but it finally managed to break above that resistance back in June, and spiked all the way to 0.8120’s in September.

Since then, the pair has been declining gradually on negative economic releases, dovish RBA remarks and the US Dollar upward retracement.

At the beginning of this week, the pair retested the solid support area at 0.78 and managed to bounce off that support. Yet, today’s data pushed the pair lower, reaching as low as 0.7830’s until this report is released.

Technically, another leg lower could be seen to retest 0.78 support once again, with the fundamental catalyst today including Retail Sales, there is a high possibility for a breakthrough that support.

If so, 0.7770’s might be the next level to watch, followed by 0.7730’s. Otherwise, a stabilization above the mentioned support might clear the way for another bull run. Yet, the RBA is likely to keep the dovish tone in an attempt to cap any rally.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst