Gold and Silver had few weeks of consecutive declines, after rising to new highs of this year. Gold declined for the past four weeks, while Silver posted three weeks of consecutive declines, before bouncing off its recent lows last week.

The question remains here, is it a new bullish trend and that the technical retracement is over? Let’s look at some technical and fundamental factors.

Gold Bounced off Its 61.8% Fibo

Following to our previous reports about metals last week, Gold continued to decline all the way from this year’s high around $1356 all the way to the 50% and 61.8% Fibo retracement.

Gold posted a low of $1260, while the 61.8% Fibo stands at $1263, before bouncing all the way to $1287 earlier this week.

In the meantime, this week’s early rally comes on the back of the renewed geopolitical tensions between the US and North Korea, which set to conduct a new missile test later this week according to many reports.

Yet, from a technical point of view, the technical retracement should be over especially if Gold continue to trade above that 61.8% Fibo.

The next immediate resistance area stands between $1290 and $1300, which should be watched very carefully, as a break above that resistance is needed, to confirm that the downside retracement move is over.

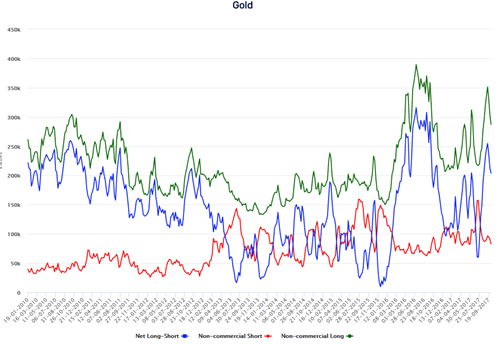

Longs Are Still In Control

The latest CFTC Data showed a notable decline in Non-Commercial Longs, declining for three weeks in a row.

However, the Non-Commercial Shorts, continue to slide further, reaching the lowest level since May of this year, leading the Net Long/Short to decline for two weeks in a row. Yet, as long as Shorts remains on the downside, there is only a little chance for a downside pressure in Gold.

Moreover, the latest known ETF holdings of Gold remains on the upside since the beginning of this week, reaching the highest level in a week, which means there is no liquidation of Gold holdings as of yet, despite the recent declines in Gold.

Silver Above $17

Silver outperformed Gold last week as it closed last week’s trading higher, with a bullish shooting star on the weekly chart.

In addition, Silver bounced off its 61.8% Fibo Retracement as shown on the chart, which stands at 16.56 and broke above $17 earlier this morning.

For the time being, it seems that the technical downside retracement is over, especially that Silver managed to stabilize above that 61.8% Fibo for five consecutive days.

In the meantime, the next resistance area remains at $17.20, which should be watched very carefully, as a break above that resistance would confirm that the downside retracement is over, and that the bullish trend has resumed.

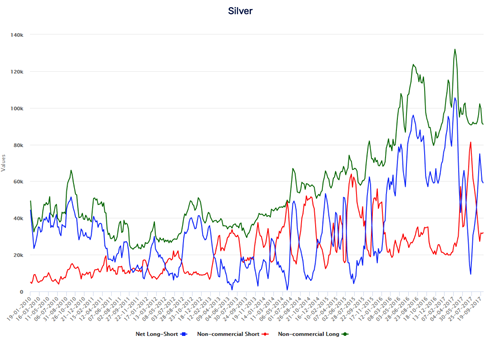

Latest COT Data

The latest Commitment of Traders Report by the CFTC showed some changes in retail positioning. Yet, it is still supporting the idea of further gains ahead.

Non- Commercial Longs declined for only two weeks in a row, while Shorts remained at the lowest level since April of this year, which could mean that the resent decline in Longs is only a short term play.

For the time being, metals remain positive on the year, and the bullish trend is likely to resume later this year. This is as long as Metals continue to trade above its recent lows.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst