Gold and Silver declined last week after three weeks of consecutive gains, posting new highs of this year, despite the fact that the estimates for both metals has been bearish at the beginning of this year.

Few weeks back, both metals made a clear breakout formation on the short and the medium term, and many of the global banks has changed their yearend target higher.

The question remains now, is it too late to buy metals after this breakout? Will the current downside move is a retracement or a trend?

Strong Demand

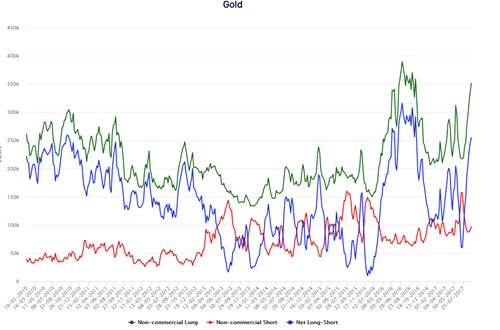

Looking at the recent data, hedge funds and investment portfolios are still buying gold for the second month in a row, one we have not seen since the beginning of 2016, reaching the highest level since the beginning of July.

Moreover, the latest Commitment of Traders report by the CFTC continues to show a notable rise in Non-Commercial Longs, while Non-Commercial Shorts remains on the downside.

Non-Commercial Longs increased for seven weeks in a row, reaching the highest level since September of last year, while Short contracts are now at the lowest level since April of this year.

Silver Demand

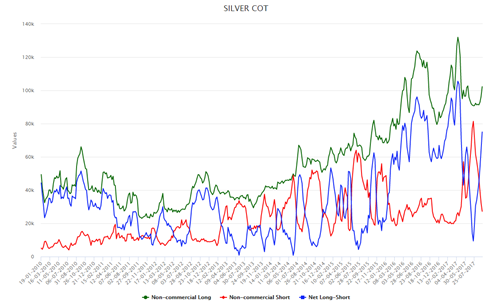

The story is totally different than Gold, Silver demand is not as strong as Gold once again. The last known ETF’s holdings of Gold has been declining for the past two months, declining all the way back to the lowest level since May of this year.

However, on the other hand, the CFTC data is showing exactly the opposite, Non-Commercial Longs remains near its record high, while shorts declined sharply over the past three weeks to the lowest level since April of this year.

Gold Remains Bullish Above 1290

Gold declined back from this year’s high at 1356, which is the highest level since July of 2016, all the way to $1304, earlier this week, loosing around 3.8% from its highs.

However, we look at the current move as a normal retracement move, which likely to be short lived, probably above 1300 and or 1290. As long as Gold continues to trade above those levels, the bullish outlook is here to stay.

On the upside view, the first immediate resistance stands around $1320 followed by 1332, while a break above those resistance would clear the way for further gains, probably toward 1240 and likely to retest this year’s high around 1356.

Silver May Test $20 Soon

Silver declined back from 18.20’s all the way to 17.11 earlier this week, which represents a strong support area, which should be watched carefully over the coming few days.

A break below that support might be a sign that the current retracement move is likely to continue to the next support area, which stands at $16.79, where buyers are likely to appear.

The bullish outlook remains as long as silver continues to trade above $16. On the upside view, Silver needs to break that $18.20 mark in order to open the way for another bull run to test this year’s high around 18.40 and 18.60.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst