Today marks the last trading day of this week, last trading day of September and the last trading day of the third quarter of this year.

The last hours of the week, month and quarter will likely provide more choppy trading as positions are adjusted across the board.

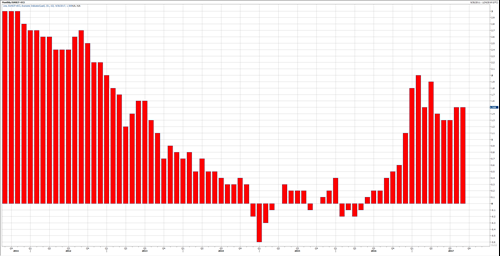

USDX Monthly Outlook

The US Dollar Index might post its first positive monthly close after declining for six consecutive months. Yet, this is not a fact yet, there are still few hours until the monthly close, and things might change.

However, looking at the monthly chart, In August, the USD Index closed below 93.15 support area. This month, it will be the key on whether to continue with its downtrend, or to be the beginning of another medium-term retracement.

A monthly close below the mentioned support would keep the possibility for another leg lower in October. Otherwise, another rally could be seen in the coming weeks, probably toward 94.00 maybe 95.0.

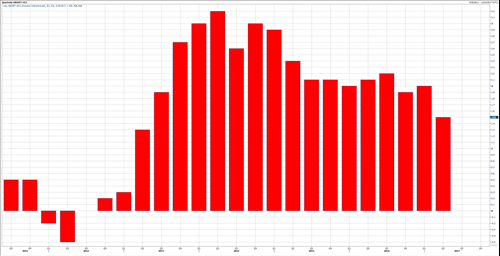

Euro Zone Inflation Slowed in September

During the European session today, the Euro Zone inflation figures were released, which came in with a little bit of a disappointment.

The YoY Flash CPI stayed at 1.5% in September, even though the estimates were to tick higher toward 1.6%. Yet, September’s reading remains the highest reading in six months.

On the other hand, the YoY Core CPI unexpectedly ticked lower to 1.1% in September compared to 1.2%, in August, while the estimates were to remain stable. This is the lowest reading in three months.

EURUSD Remains Solid Above 1.1720

The Euro managed to post its 2nd daily gain including yesterday and today, despite the fact that the Euro Zone inflation data came in slower than expected.

Yet, the support area that held well since Mid-August remains solid until this report is released, which eases the possibility for another leg lower ahead.

Yet, the Euro needs to prove its strength over the coming hours. The next resistance area stands at 1.1825, followed by 1.1870’s. Otherwise, the risk for another leg lower is here to stay.

UK Data Disappoints

Most of the economic releases from the UK came in with a disappointment today, including the Current Account deficit and the GDP as Brexit uncertainty remains all over the place.

The Current Account deficit unexpectedly increased to -23.2B in Q2 compared to -22.3B in Q1 of this year, despite the fact that the estimates were to decline sharply to -15.8B. This is the second quarterly increase in a row, one we have not seen since 2007.

The GDP figures also came in with a disappointment, the QoQ Final GDP remained at 0.3% as widely expected, but the YoY slowed down to 1.5% down from 1.7%, which is the lowest reading since Q2 of 2013.

GBPUSD Is Stuck

The British Pound is now stuck in a significant area between 1.3360 support area and 1.3440 resistance area, which should be watched carefully over the next few hours.

Today’s data does not support the possibility for a rate hike by the BOE in November. At the same time the BOE Mark Carney mentioned that the next rate hike cycle will be very gradual.

From a technical point of view, GBPUSD is still strong as long as it stays above this week’s low. Otherwise, a weekly close below 1.3360’s would clear the way for another leg lower, possibly toward 1.3220’s, where buyers are likely to appear.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst