Until the end of last week, Crude Oil prices had its best four trading weeks since the beginning of this year.

Brent Crude Spiked for four weeks in a row, reaching as high as $59.50, while WTI Crude also posted four weeks on consecutive gains reaching as high as $53.

Yet, both crudes declines sharply since the beginning of this week. Is this a technical retracement? Or a new trend?

Why Crude Spiked To New Levels?

Here we have to look at the history of the price. However, there is no need to keep on saying that the market always price in future events in advance.

Recently, there were many remarks by OPEC and Non-OPEC producers about the idea to extend the current deal for another three months.

The current deal expires in March of next year, while the extension means that the it will expire in June of next year.

This is one of the main reasons behind the current rally.

Demand Is Still Short

Despite the recent rise in Crude Oil prices, the demand is still below this year’s high, or its not even close to 2013 peak.

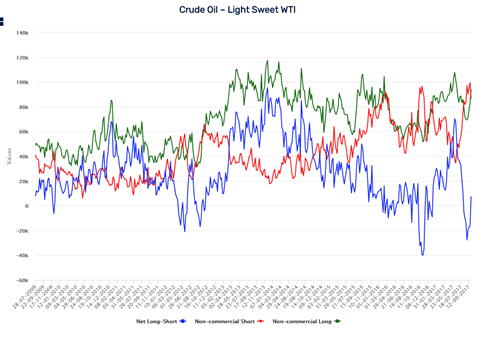

Non-Commercial Longs has increased for the past three weeks, reaching the highest level since June of this year. However, the Non-Commercial Shorts are still near record high, despite the fact that it declines over the past two weeks.

At the same time, the Net Long-Short rebound recently above the zero barrier, which means that bulls are back in control, but its not enough for another rally yet.

Brent Crude Doesn’t Look Good

Brent Crude failed to close last week in green, and closed once again below 56.88 solid resistance level, which held since November of last year.

So far, we haven’t seen any clear weekly close above that resistance, which keeps the possibility for another leg lower in the coming days.

At the same time, Brent has been declining for five consecutive days, but still supported above the 56.0 support area, which should be watched carefully over the coming days. A breakthrough that support would clear the way for further declines, possibly back to 55 and even 54 to retest its daily trend line.

Otherwise, a weekly close above 56.80’s is needed once again to renew the bullish outlook.

WTI Crude Nearing $50

WTI spiked above $50 at some point, but it failed to stabilize above 51.50 resistance area and declined back all the way to 50.30’s earlier this morning.

For the time being, the $50 mark is the most solid support that we have to keep an eye on. A stabilization is needed to keep the short term bullish outlook in place.

Otherwise, WTI Crude will be at risk to lose the past four weeks gains, with a possibility to test 47.50 and even $46.

On the upside view, a stabilization above $50, would keep the possibility for another bull run, but this time, it would probably break above that 51.0 resistance area, and might test April’s resistance which stands around 53.0.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst