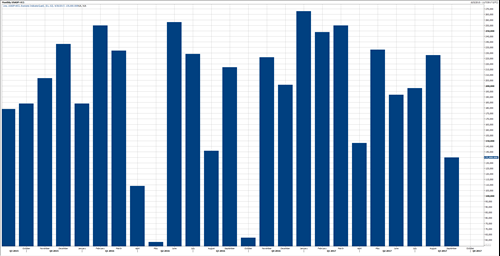

The ADP Non-Farm Employment Change data came in with a little surprise in September, adding 135K new jobs, while the estimates were to add around 125K.

Moreover, the previous reading for the month of August has been revised lower by 9K to 228K instead of 237K.

This is the weakest reading since October of 2016, posting the first slowing down, after two months of consecutive growth.

No Big Reaction, Yet!

Despite the slowing down in ADP which declined to the lowest level since October of last year, the US Dollar Index remained lower on the day after the numbers.

It seems that traders are waiting for something bigger than this number, which make sense for now. All eyes will be waiting for the US Jobs Report on Friday.

ISM Non-Manufacturing PMI Ahead

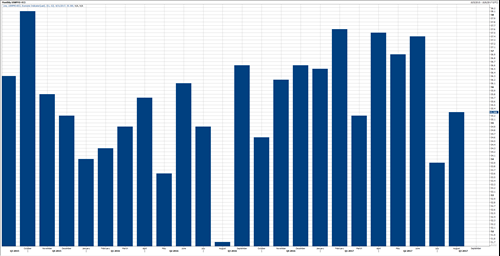

During the US Session, traders will be watching the ISM Non-Manufacturing PMI, which should be watched very carefully, especially after the notable rise in ISM Manufacturing PMI yesterday.

Estimates are pointing to a slight increase today toward 55.5 in September compared to 55.3 in August, which would be the second monthly increase in a row, one we haven’t seen this year and the highest since June of this year.

Moody’s Warned The US Again

Moody’s credit rating agency threatened the US earlier this morning to downgrade its credit rating, if Trump tax plan is passed. This is one of the main reason for today’s selloff in USD.

Moody’s noted “The Trump tax framework is likely credit negative for the U.S. government. Tax cuts would not be offset by equivalent cuts to spending, which would put upward pressure on the federal budget deficit and debt”

Its interesting how Moody’s decided to talk about the issue of the Federal Debt when it the Total Public Debt is at record high.

USD Index Failed To Break Higher

The US Dollar Index tried to break higher yesterday, after breaking above its 93.60’s resistance area and tested the 2nd resistance area on the daily chart which stands at 93.84.

However, it failed to sustain its gains and declined all the way back and closed the day slightly higher, almost unchanged, right at 93.60’s.

Earlier this morning, Moody’s earning has sent the index lower back to 93.30’s, and it continues to trade around that area until this report is released.

In the meantime, a solid resistance area stands between 93.60’s and 94.15, which I believe that it would be the end of the US Dollar retracement, before the downside pressure resumes.

Yet, a catalyst is needed, which might come from today’s ISM Non-Manufacturing PMI data, but most probably on Friday’s Jobs Report.

Either way, the general outlook remains bearish on most timeframes, with a short-term retracement to the upside, which likely to be capped below the levels mentioned above.

On the downside view, the first immediate support remains at 93.0., while a breakthrough that support, would renew the bearish outlook, which might continue toward 92.70’s and 92.40’s for now.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst