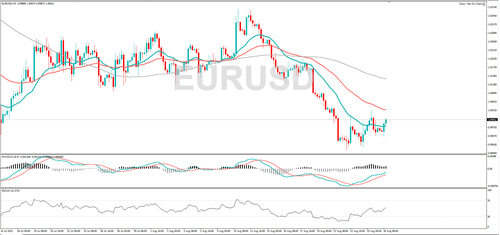

EUR/USD fell to a 20-year low on Tuesday, but positive momentum is increasing, suggesting the bulls are in control. If the wider downtrend continues, it might target 0.9950 or 0.9909. If the short-term rebound continues, it might hit 1.0032 or 1.0068.

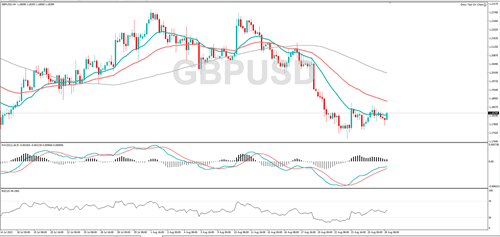

This week, GBP/USD traded at a 17-month low, and if the bearish trend continues, it might target 1.1755 or 1.1716. RSI is moving higher, implying the price bias is to the upside. If the recovery continues, 1.1877 or 1.1895 might act as resistance.

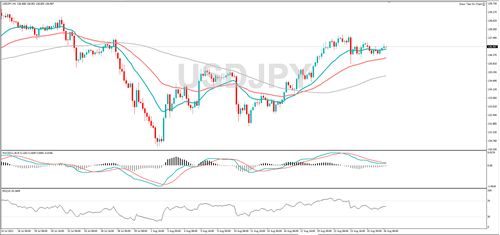

USD/JPY retreated from its one-month high. If the uptrend continues, 137.44 or 137.94 might act as resistance. Momentum is in negative territory, implying the bears are in control. A fall from here could see it find support at 135.80 or 135.63.

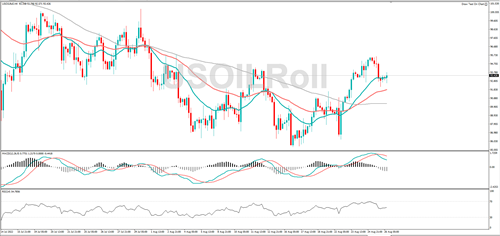

WTI retreated from its three-week high and momentum has turned negative, suggesting the bears are now in control. If the wider rally continues, it might target 95.58 or 97.54. Should the market fall from here, it could find support at 92.16 or 90.94.

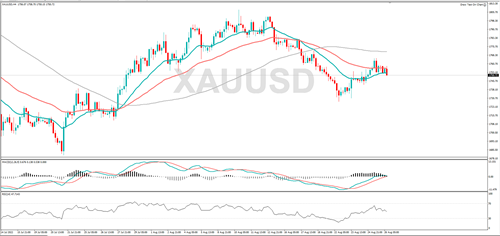

Gold is edging lower; the RSI is falling too and that implies the price bias is to the downside. If gold falls further, it might target 1742 or 1730. If gold’s medium term uptrend resumes, it might target 1766 or 1772.

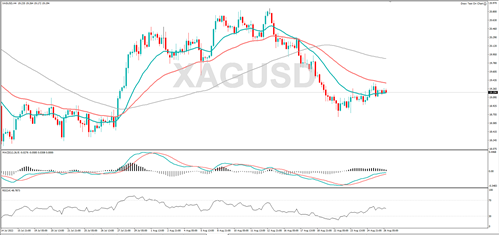

Silver is recovering, but positive momentum is in decline, which suggests the bulls are losing influence. 19.42 or 19.56 might act as resistance. If the long-term downtrend continues, support might be found at 19.09 or 19.00

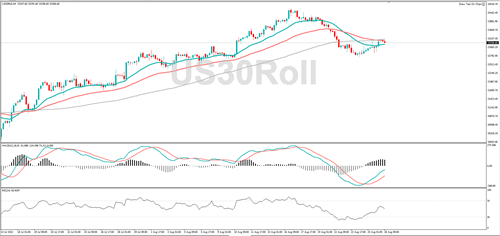

The short-term trend for the Dow Jones is higher, and the RSI is rising, indicating the price bias is to the upside. A rally from here could see it target 33446 or 33590. If the medium-term downtrend resumes, it might find support at 33048 or 32884.