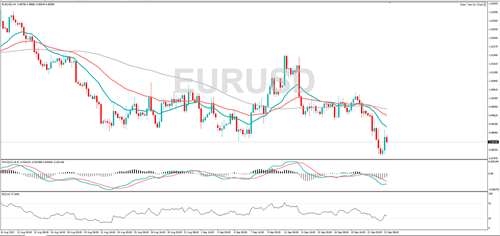

EUR/USD fell a new 20-year low and if the wider bearish move continues it could target 0.9800 or 0.9700. The short-term trend is higher, and negative momentum is falling, implying the bears are not as influential as they once were. Resistance might be found at 0.9937 or 1.0000.

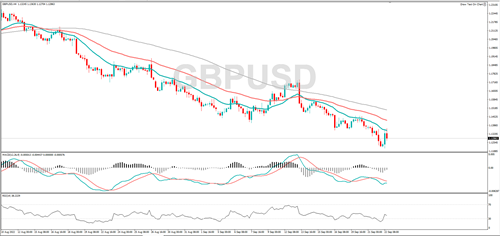

GBP/USD is in a downtrend and if the wider bearish move continues, it might find support at 1.1270 or 1.1200. Negative momentum is falling, implying the sellers are losing influence. RSI is rising and that suggests the price bias is to the upside. 1.1356 or 1.1400 might act as resistance.

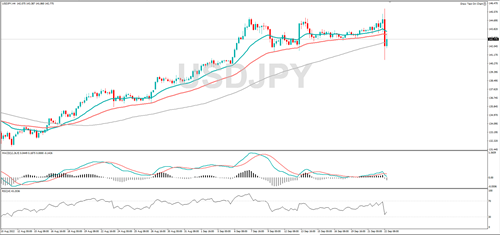

USD/JPY dropped aggressively, and momentum has turned negative, suggesting the bears are in control. If the downtrend continues, it could target 140.65 or 140.00. Should the longer-term bullish trend continue, it might target 143.50 or 144.00.

The Dow Jones fell to a two-month low, and if the longer-term downtrend continues, it might find support at 29954 or 29758. Negative momentum is dropping, and the RSI is rising, this could be a sign a rebound is in the offing. A rally from here could see it target 30464 or 30920.

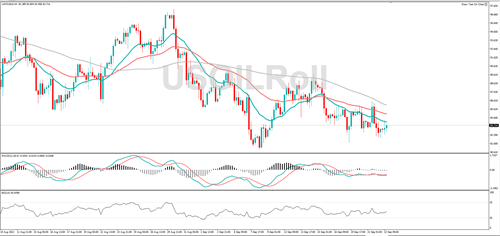

WTI is trending lower, momentum is in negative territory and that implies the sellers are dominant. Should the wider bearish move continue, it could find support at 81.69 or 81.00. The RSI is creeping higher, and that suggests the price bias is to the upside. A rally might target 84.00 or 85.00.

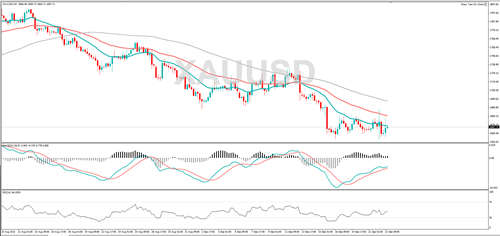

Gold fell to a two-year low last week, and if the wider bearish move continues it could target 1660 or 1654. The RSI is rising, and momentum is positive, if the near-term bullish move continues it could hit 1673 or 1687.

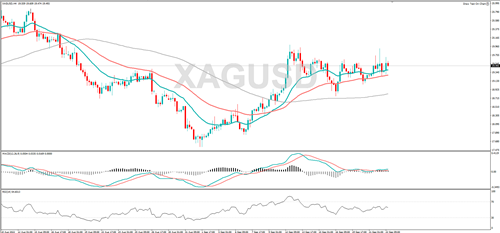

Silver is trending higher, the RSI is rising, and momentum is positive, this speaks to bullish sentiment. A rally might encounter resistance at 20.00 or 21.00. If silver were to decline, it could find support at 19.23 or 19.00.