EUR/USD traded below parity for the first time since mid-July, momentum is negative, suggesting the sellers are in control. It might find support at 0.9951 or 0.9900. RSI is in overbought territory so that could be a warning a change in trend is in the offing. A rebound could see it hit 1.0088 or 1.0173.

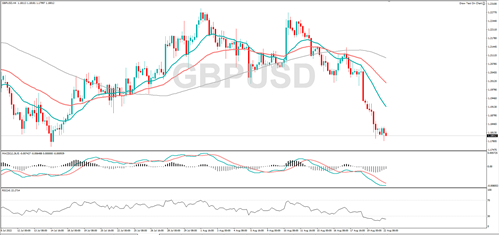

GBP/USD is under pressure, it fell to a new one-month low, and if the bearish trend continues, it might target 1.1759 or 1.1638?. RSI is in oversold territory so we might see a rebound, a rally from here might run into resistance at 1.1926 or 1.2000.

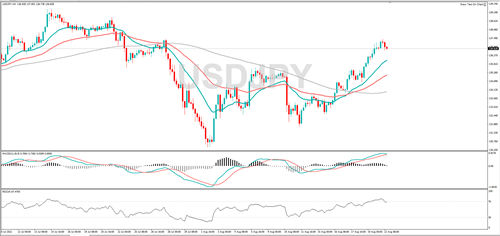

USD/JPY jumped to a new three week high, and the MACD indicator shows that positive momentum is fading, implying the bulls are losing influence. If the wider uptrend continues, 138.86 or 139.39 might act as resistance. A fall from here could see it find support at 135.63 or 134.64.

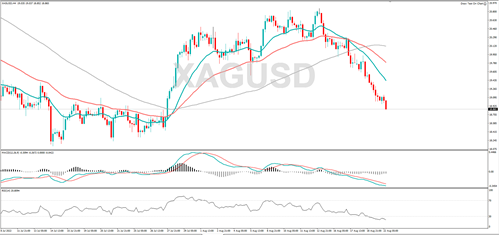

Silver has dropped to its lowest mark since late July and momentum is in negative territory, and that implies the bears are in control. If the downtrend continues, 18.64 or 18.31 could act as support. A rebound might target 20.12 or 20.37.

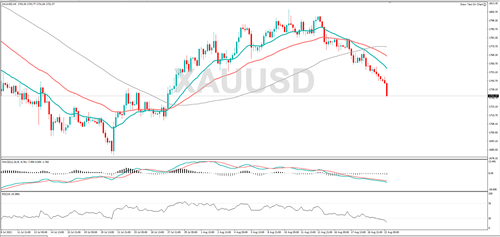

Gold fell to a three-week low and momentum is in negative territory, implying the sellers are in control. If the sell off continues, it might target 1719 or 1703. If the metal rallies from here, it could retest 1760, and a break above that level could bring 1781 into play.

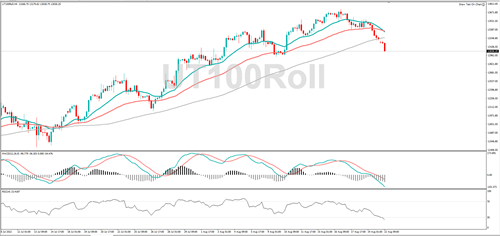

The UT100 fell to a 12-day low, and there is an increase in negative momentum, highlighting the bears dominance. If we see further losses from here, 12943 or 12795 could act as support. RSI is in overbought territory so we might see a rebound. Resistance might be found at 13364 or 13723.

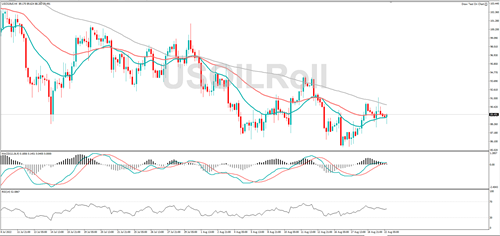

WTI is trending lower, and if the wider bearish move continues, 86.84 or 85.37 could act as support. RSI is falling, and positive momentum is fading, both speak to bearish sentiment. A snapback might target 90.46 or 91.62.