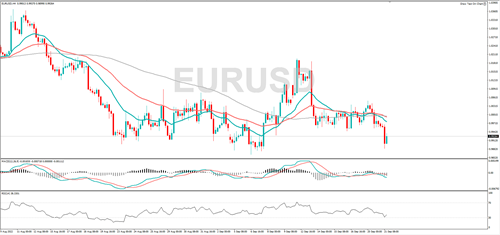

EUR/USD is trending lower and negative momentum is rising. A fall from here could see it find support at 0.9863 or 0.9800. The RSI has rebounded, and it is pointing higher, this could be a sign that sentiment is turning positive. 0.9967 or 1.0000 might act as resistance.

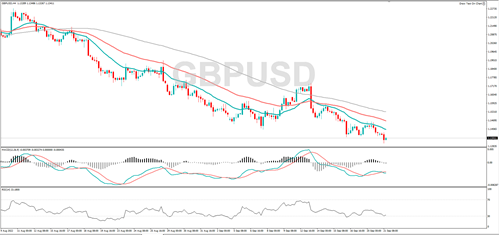

GBP/USD fell to a new 37-year low. The RSI is falling and momentum is in negative territory, if the long-term negative trend continues, it might target 1.1300 or 1.1200. A rally from here might encounter resistance at 1.1386 or 1.1400.

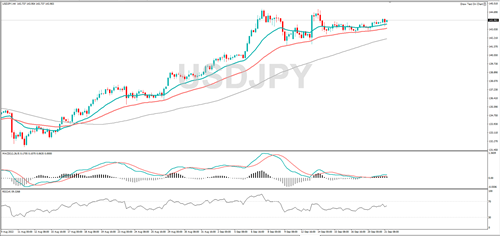

USD/JPY is creeping higher. Momentum is positive and RSI is rising, both speak to a bullish mood. A rally from here, could see it hit 145.00 or 146.00. A pullback might find support at 143.33 or 142.92.

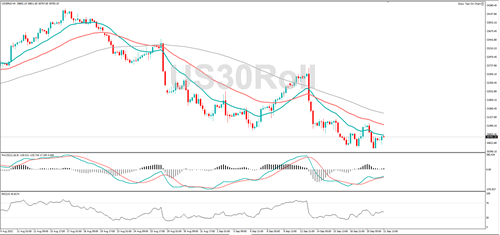

The Dow Jones fell to a one-month low yesterday, and if the longer-term downtrend continues, it might find support at 30464 or 30400. The RSI is rising, and momentum is positive, if the near-term bullish move continues it could hit 31000 or 31275.

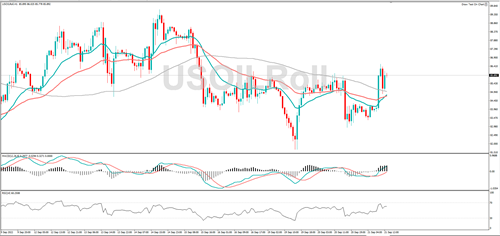

WTI is trending higher, momentum is positive, and RSI is rising, this indicates bullish sentiment. A rally could target 86.52 or 87.00. The longer-term trend is lower, a fall from here could see it hit 85.04 or 84.83.

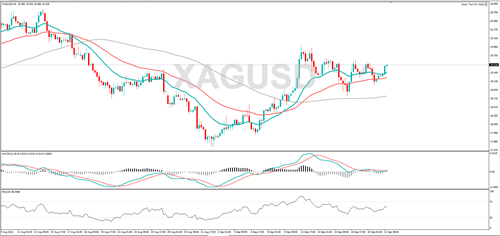

Gold fell to a two-year low last Friday, and if the wider bearish move continues it could target 1664 or 1659. The RSI is rising, and momentum is positive, if the near-term bullish move continues it could hit 1679 or 1690.

Silver is trending higher, the RSI is rising and momentum has turned positive, this speaks to a renewed bullish sentiment. A rally might encounter resistance at 19.64 or 20.00. If silver were to decline, it could find support at 19.09 or 18.83.