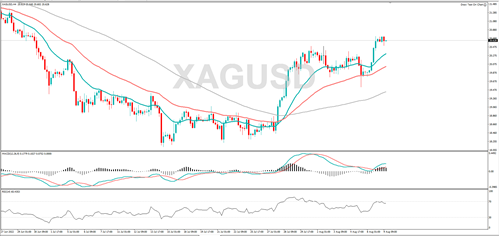

Silver is trending higher, and momentum is positive, which suggests the buyers are dominate. 21.35 or 21.52 could act as resistance. RSI is turning lower, so that could be a sign a change in the trend is in the offing. 20.00 or 19.53 could act as support.

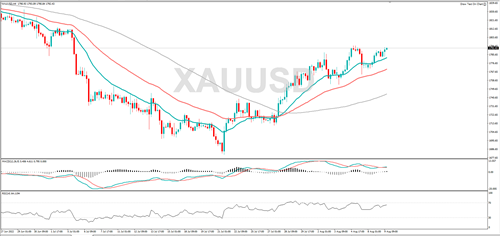

Gold is rising, and momentum has now turned positive, implying the bulls are in control. If the uptrend continues, it might target 1800 or 1811. A pullback could retest 1753 or 1736.

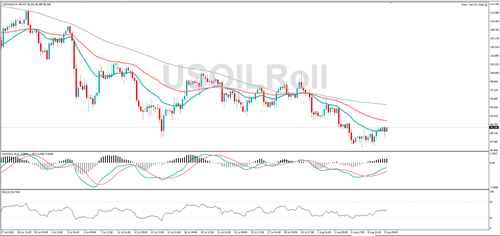

WTI fell to a 6-month low last Friday, and RSI is retreating, suggesting the price bias is to the downside. If the bearish move continues, 85.84 or 83.33 could act as support. Resistance might be found at 91.25 or 94.09.

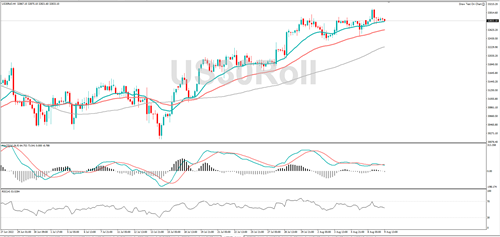

The Dow Jones is enjoying a bullish run and yesterday it hit a two-month high. If the rally continues, it could target 33322 or 33474. The RSI is edging lower, suggesting the price bias it to the downside. Support might be found at 32475 or 32378.

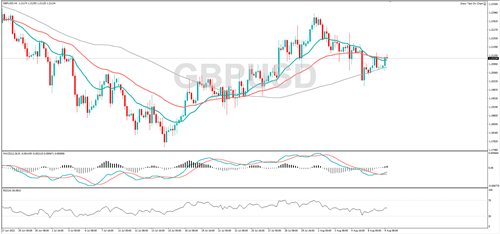

GBP/USD is edging higher, and RSI is rising, suggesting the price bias is to the upside. Resistance might be encountered at 1.2214 or 1.2292. If the wider bearish trend continues, it might find support at 1.2002 or 1.1962.

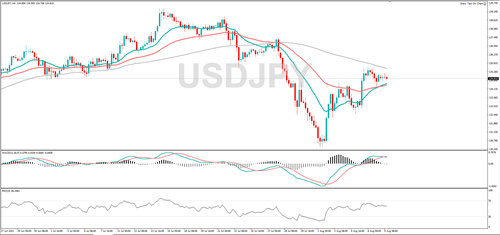

USD/JPY is moving higher, but momentum has turned negative, suggesting the buyers are no longer in control. A fall could see it target 132.83 or 132.51. If the broader uptrend continues it might target 136.57 or 137.45.

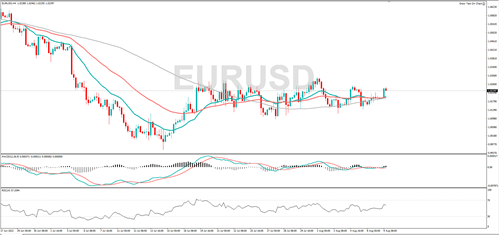

EUR/USD is edging up and the MACD indicator shows that momentum is positive, implying the bulls are dominant. If the rally continues, it might run into resistance at 1.0293 or 1.0324. A fall from here might see it find support at 1.0121 or 1.0095.