WTI fell to a 5-month low yesterday and RSI is in decline, suggesting the price bias is to the downside. If the bearish move continues, 85.84 or 83.33 could act as support. Resistance might be found at 91.25 or 94.09.

The NASDAQ 100 has retreated from its seven-month high, and momentum has turned negative, suggesting the bears are now dominating. If the broader uptrend continues it might target 13555 or 14000. A move to the downside, could find support at 13165 or 13041.

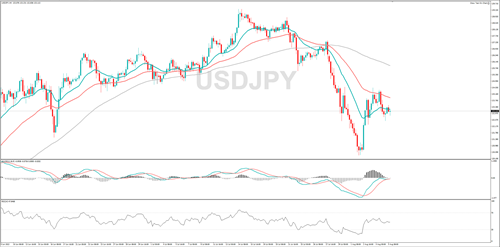

USD/JPY is moving lower once again and momentum has turned negative, implying the sellers have regained control. If the bearish move continues, it could hit 132.95 or 132.20. 134.59 or 135.74 might act as resistance.

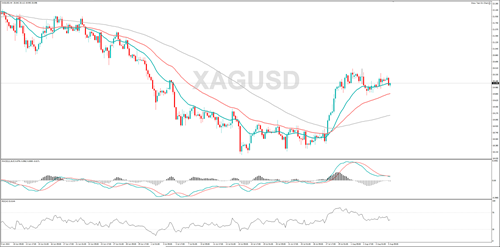

Silver is pushing lower and so is the RSI, and that indicates the price bias is to the downside. 19.76 or 19.27 could act as support. If the wider bullish trend resumes, 20.49 or 20.80 might act as resistance.

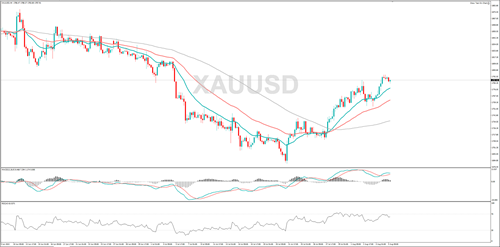

Gold is trending higher, and but positive momentum is fading, implying the bulls are losing a bit of control. If the uptrend continues, it might target 1800 or 1811. A pullback could retest 1753 or 1736.

GBP/USD has pulled back from the five-week high set at the start of the week, and RSI is moving lower, suggesting the price bias is to the downside. 1.2065 or 1.2000 could provide support. A break above 1.2214 could bring 1.2292 into play.

EUR/USD is edging higher and the MACD indicator shows that momentum is positive, implying the buyers are dominant. A rally from here could see it target 1.0293 or 1.0324. A decline might see it find support at 1.0095 or 1.0027.