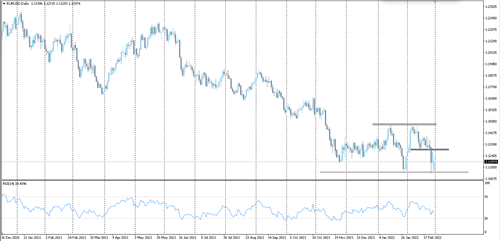

EURUSD

The pair fell strongly to test the support level 1.1120, but it succeeded in rebounding from it, and by maintaining this support, the rise is likely to extend to 1.1290 levels.

The support level for the pair 1.1120, if broken, may extend the decline to 1.1050 levels.

GBPUSD

The pair is still maintaining the 1.3350 support level, so by maintaining it, the current rise will likely extend to 1.3500.

But if the support 1.3350 is broken, this will likely contribute to the extension of the decline to 1.3280 - 1.3200 levels.

USDJPY

The pair succeeded in rebounding from the support level at 114.35, and it will likely test the resistance 116.35, which represents the upper border of an ascending triangle on the daily chart, and by breaching this resistance it is likely to extend the rise to levels 117.00-117.50.

Support levels for the pair 114.80-114.35

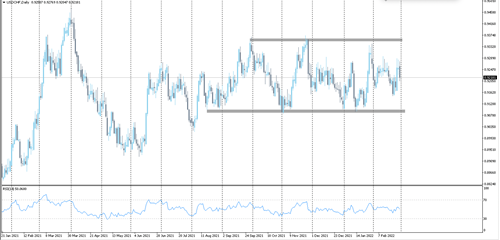

USDCHF

The pair is moving in a sideways range on the daily chart. After testing the upper boundary of the channel at 0.9350, it retracted from it, and the current decline is likely to extend the test to the 0.9090 support, which represents the lower boundary of the horizontal channel.

The price resistance levels are 0.9270-0.9350.

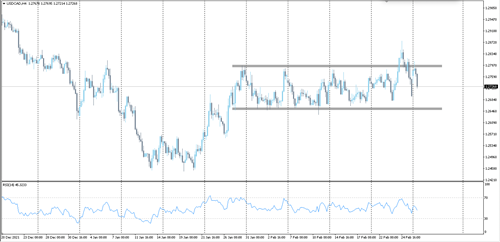

USDCAD

The pair failed in stabilizing above the resistance level 1.2800 and fell below it again, but it is still stable above 1.2650, which if broken, may extend the decline to the level of 1.2570.

But if it succeeds in stabilizing above the 1.2800 resistance, this may contribute to the extension of the rise to 1.2870/1.2900 levels.

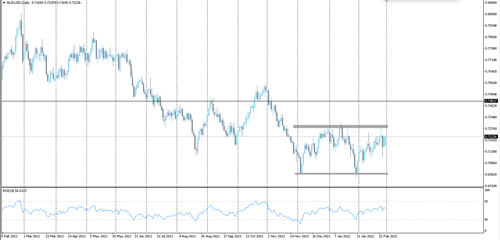

AUDUSD

The pair rose and approached the strong resistance level 0.7300, which is likely to be breached, and this may contribute to extending the rise to levels 0.7400-0.7450.

But if the pair fails to stabilize above the 0.7300 level, it will likely resume the decline to 0.7170 levels.

Gold

Gold still failed in stabilizing above the resistance level of $1920, which is likely to extend the rise to the levels of 1935-1950.

But if it fails to surpass the 1920 resistance, it is likely to return to the decline to levels of 1885-1875.

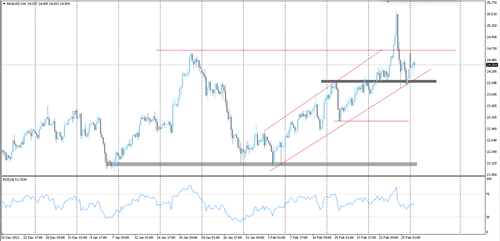

Silver

Silver is moving between the borders of an ascending channel and rebounded from its lower border and succeeded in surpassing the $24.00 resistance level, so the rise is likely to extend to 24.60-2500.

However, if the price fell from the current levels, it may face the support levels 23.60/40, which in case of breaking them may extend the decline to the level of 23.00.

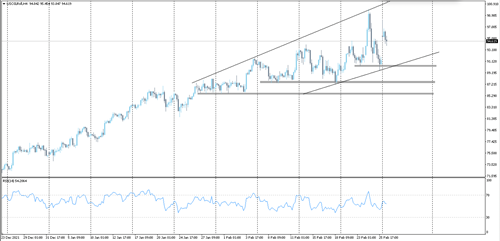

Oil

Oil is moving between the borders of an ascending channel and rebounded from its lower border at 89.50 and is now trading around 94.50, and the rise is likely to extend to 9800-100.00 levels.

Support levels are 89.50-87.00.

Dow Jones

The Dow Jones index declined and succeeded in achieving the downside target of 33000 and rebounded from it to 33600 levels, and it is likely to return to the decline to 33000 points, which if broken may extend the decline to 32500-32000 levels.

The resistance levels are 34100-34500.

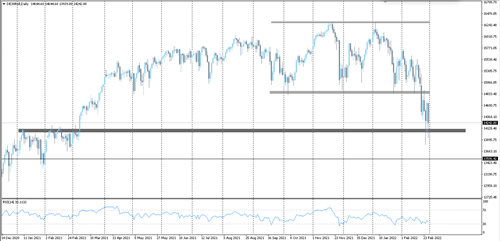

DAX

The German DAX index fell and tested the support level 13800, but succeeded in rebounding from it, and it is likely that by maintaining it, the correction will extend upwards to the test at 14500-14800 levels.

Support levels are 13800-13500.