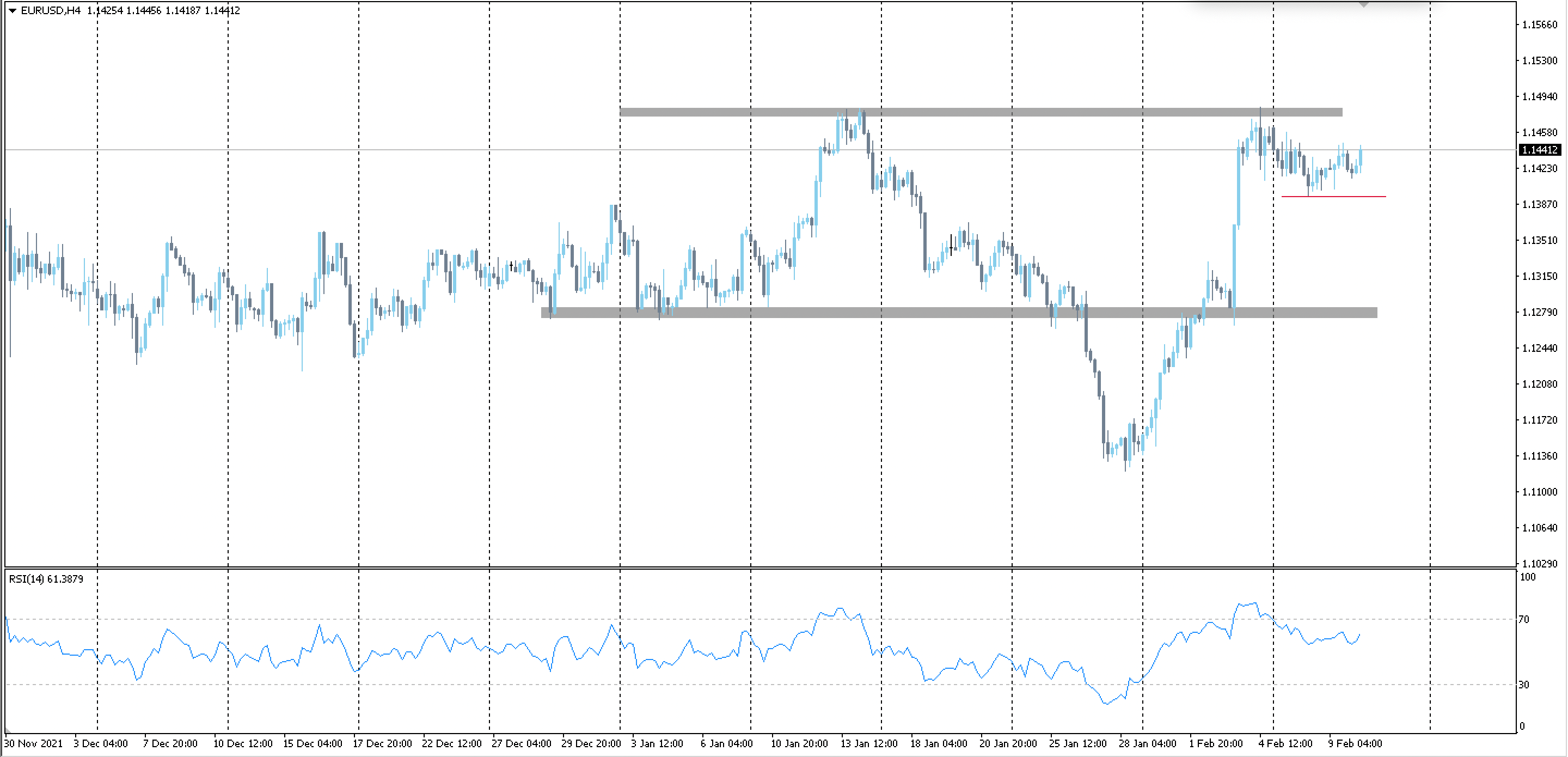

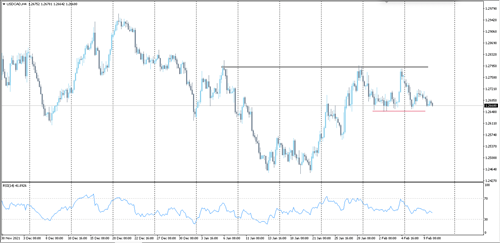

EURUSD

The pair still maintains the 1.1394 support level, and by maintaining it, it is likely to test the 1.1480 resistance, by which it may extend the rise to 1.1530 - 1.1600 levels.

But if the support 1.1394 is broken, the decline is likely to extend to the levels of 1.1350 - 1.1270.

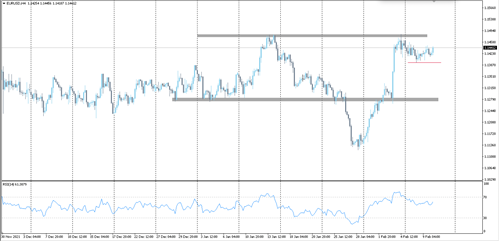

GBPUSD

The pair is facing the resistance level of 1.3585, and it is likely that by surpassing it, the rise may extend to 1.3625/1.3650 levels.

But if the support 1.3500 is broken, the drop will likely extend to 1.3440 - 1.3360 levels.

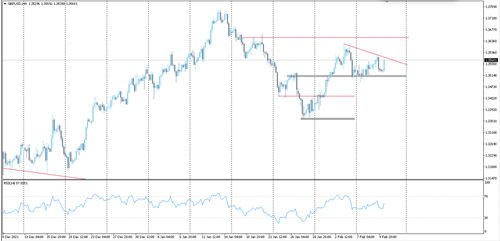

USDJPY

The pair succeeded in surpassing the resistance level at 115.70, and it is likely that if prices remain above this level, the rise will extend to levels of 116.25.

But if the price fell below 115.70, the decline will likely extend to 114.80 levels.

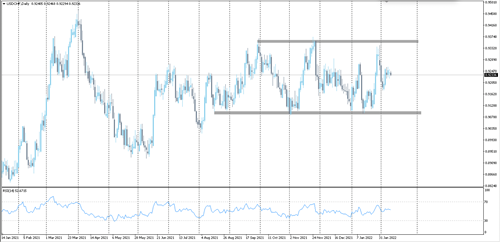

USDCHF

The pair is moving in a sideways range on the daily chart. After testing the upper boundary of the channel at 0.9350, it retracted from it, and the current decline is likely to extend the test to the 0.9090 support, which represents the lower boundary of the horizontal channel.

The price resistance levels are 0.9270-0.9350.

USDCAD

The USD/CAD pair fell from the resistance level of 1.2800, and the decline is likely to extend to 1.2650 levels, which if broken, may extend the decline to 1.2570.

But if it succeeds in surpassing the resistance of 1.2800, this may contribute to the extension of the rise to 1.2860/1.2700 levels.

AUDUSD

The pair is facing price resistance around the 0.7170 level, and if it succeeds in surpassing this level, the rise will likely extend to the levels of 0.7215-0.7250.

Support levels for the pair are 0.7130/0.7100.

Gold

Gold succeeded in rising near the resistance level of 1830 and by not exceeding this level it is likely to face some correction to the levels of 1815-1800.

But if it succeeds in surpassing the resistance 1830, the rise will likely extend to the levels of 1840-1850.

Silver

Silver succeeded in achieving its expected target at 23.30, and by not exceeding this level it is likely to face some correction to the support levels 22.70-22.00.

But if the resistance 23.30 is exceeded, the rise is likely to extend to levels 23.70-24.00.

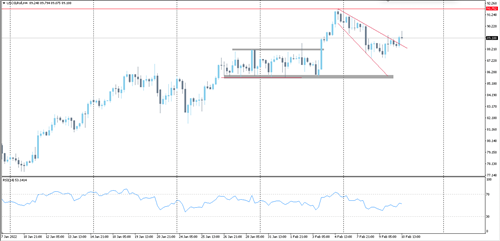

Oil

After oil ascended to the level of 91.75, it faced some correction to 87.40, and by breaking it, the correction may extend to 85.70 levels.

Resistance Levels are 90.00-91.75

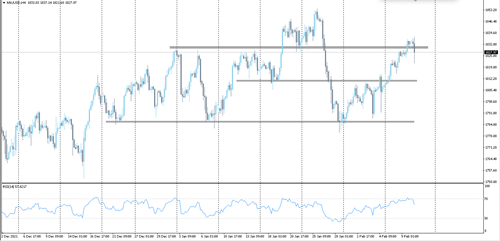

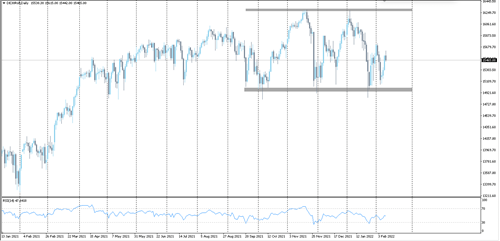

Dow Jones

The Dow Jones is testing the resistance 35700, and it is likely that by surpassing it, the rise will extend to 36500 levels.

But if the price fell from the current levels and fails to hold above 35700, it is likely to face some correction to levels 35000-34800.

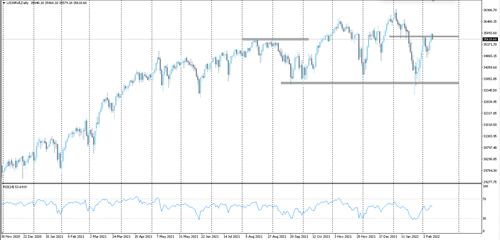

DAX

The German DAX index fell to the lower boundary of the 15000 cross channel, and it is likely that by maintaining it, it will rebound to the upside to test it at 15700-16000 levels.

Support levels 14800/15000.