The euro fell today, following news from a German newspaper that Greece may fail to pay a loan due in July if lenders fail to resolve Greek debt relief. The finance minister said his remarks had been distorted and that Greece was confident of reaching an agreement on June 15 when Eurozone finance ministers would meet again next month, wiping out the euro's losses since the beginning of the day.

Oil prices also fell today as Goldman Sachs cut its price forecasts this year on the basis of possible increases in the production of shale gas and new projects, as well as OPEC's recent agreement. Goldman Sachs forecast for Brent crude to reach 56.76$ a barrel and settled current expectations at 55.39$ a barrel, and lowered its forecast for WTI to 52.92 $ a barrel from 54.80 $ a barrel.

In the United States, consumer spending posted the biggest increase in four months in April, as monthly inflation figures rebounded in reference to strong domestic demand, allowing the Fed to continue its path towards a rate hike at the June meeting. The Core Consumer Price Index (Fed's preferred inflation index) rose 1.5% y/y in April, and the Fed's target is 2%.

On the technical view, we will take a look at the most important movements of this day through the following:

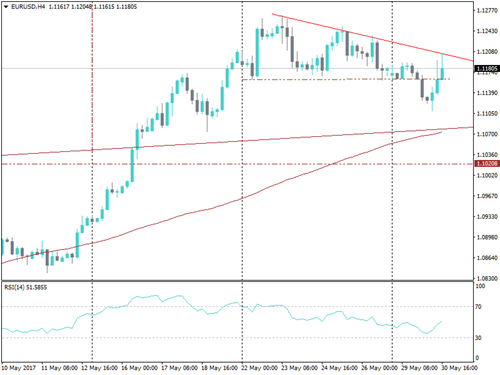

EURUSD

The pair declined with the beginning of trading day and broke the support at 1.1160 and fell to the lowest level at 1.1108, but it rose quickly again. Resistance levels of the pair will be at 1.1205 and 1.1270. We expect prices to test support level at 1.11.

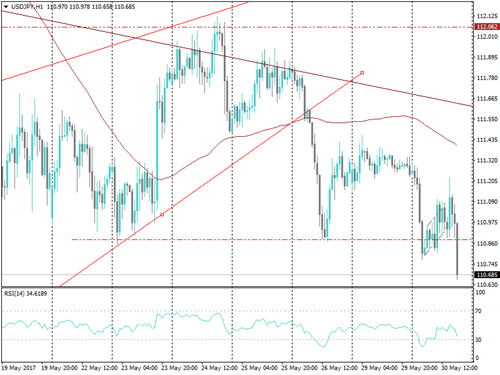

USDJPY

The pair has fallen and managed to break the support we mentioned in the morning analysis of 110.75, we expect the pair to continue declining to 110.24 and then break it targeting 109.60. Resistance levels will be at 110.90 - 111.20.

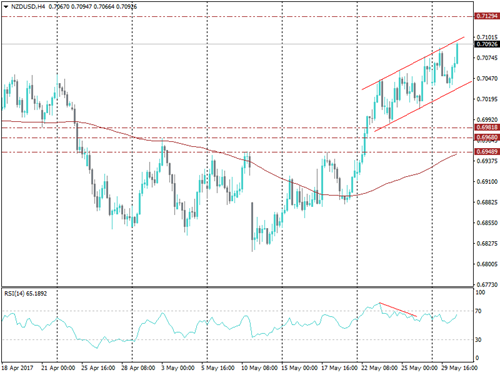

NZDUSD

The pair rose since the beginning of the trading session after maintaining its trading higher than the bottom line of ascending channel besides MA 100 on the hourly frame, it continued to rise towards resistance of the upper line of the channel at 0.71 which represents strong resistance, staying lower this level we expect prices to fall back again to 0.7040. Exceeding this resistance would send prices higher to 0.7130 then 0.7165.